Here’s Why House Prices Are So Expensive — It’s Not the Reason You Think

Homes used to be affordable, here is the real reason why they increasingly aren’t.

Any person who has desired to purchase a home will attest that doing so is becoming increasingly difficult.

The question is, why?

It’s complex is the answer. To explain, firstly, if you look at the data, it would seem that the older generations have not per se had it better.

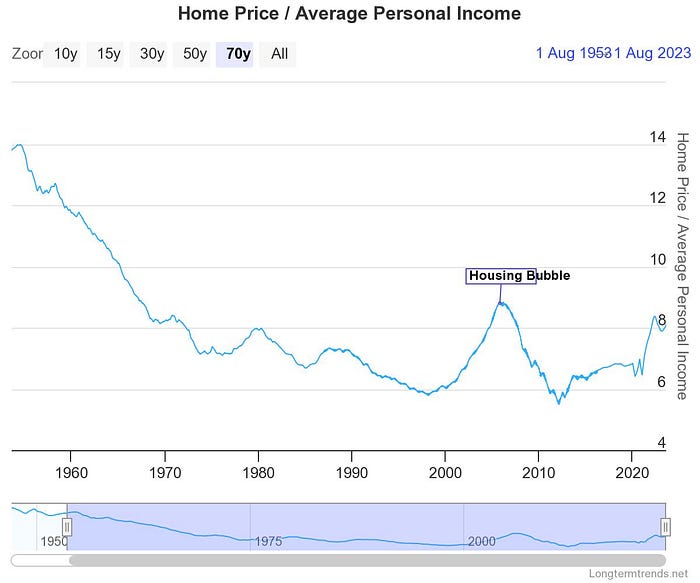

For example, in the US, for 2023, the average property has cost 7–9 times the median national wage, yet in 1947, the average property cost 15 times the median national wage.

Yes, 15 times, which is a lot more than now, and it only started decreasing in the 1960s off the back of a property boom. Even crazier, the most affordable they have been came in the 1990s, and then in the 2010s, as the below graph shows.

Yep, that means — at least in the US — present generations have seemingly actually had it better than older — at least on average i.e. ignoring the spike caused by the 2008 financial crisis and the present covid and war-induced inflationary environment.

But it’s not just in the US where this appears true. It’s the same for most other developed countries, from Canada to Europe, to the UK.

The question is what is going on? How could homes seemingly be more affordable than ever when it is clear more people than ever are struggling to purchase a home?

To answer that, we need to look at the UK because it best tells the story.

What the UK tells us about property affordability

The great thing about the UK is that due to it having been developed for so long, there is a lot of data, specifically reliable data that reports the average personal income of its citizens along with average house prices running as far back as the 1850s.

Yep, the 1850s.

This is really useful because the more data we have, the more lessons we can learn, and there are many lessons we can learn from the UK data.

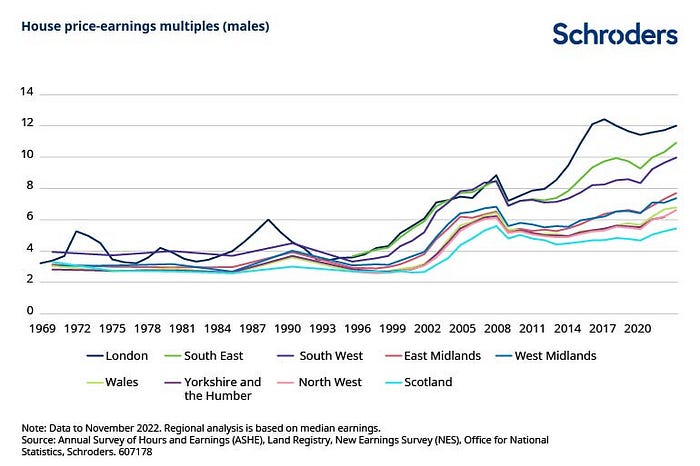

The first is that, in 2023, the average UK house cost about nine times the median wage, yet from about the mid-1920s until the mid-1990s, it cost on average around four to five times.

That tells us that over the last couple of decades, prices have increased to a level not seen since the 1800s, as the graph below shows.

The above graph also shows that UK house prices used to be pretty darn expensive in the 1800s, far more expensive than they are now.

The question is, why?

Why UK properties used to be so unaffordable

Since the dawn of the agricultural revolution, the majority of those in Britain rented. That means property ownership was for the wealthy — so the Royals and the aristocracy, who owned all the land.

Even if you built a home in the pre-industrialised world, you built that home on rented land meaning it was not yours — ever heard of leasehold properties i.e. properties where you may own the house but not the land it’s built on. That’s where such property ownership models come from.

So yeah, rent has been the universal historical norm across the globe, from Europe to China, to everywhere. Of course, there have been outliers. For example, in the early Roman Republic, soldiers were given land as a reward, meaning property ownership was a thing in ancient Rome.

Just not for long.

To explain, as Rome grew, the wealthy classes emerged and stole *cough, bought all that land, which is why when the great cities were built, there were rich and there were poor. The rich owned property, and the poor rented the property.

This is pretty much the story for everywhere. Even when homeownership appeared, it didn’t last for long.

And so the reason properties used to be so unaffordable was because the rich and powerful worked hard to make them unaffordable by keeping the poor poor and reliant.

But then along came the Industrial Revolution.

The Industrial Revolution gave birth to homeownership — not for the reasons you think

The Industrial Revolution brought mass urbanisation to the UK. However, it didn’t change the status quo of homeownership, at least not initially. So, as people moved into cities, the rich continued to own the properties, and the poor continued to rent them.

But this status quo started creating problems, mainly because of Edward Jenner and his invention of the first vaccine, specifically, for smallpox. This invention, when added to other life-saving innovations, led to an unprecedented population boom.

This population boom was so unprecedented that it created poverty equally as unprecedented.

For example, in the mid-1800s, a government inspector found 63 people living in a single house in London that had just 9 beds. Just as crazy, in St Giles, also London, 54,000 people were found to be crowded into just a few streets, and those streets did not have big houses.

In terms of why this was, it wasn’t because of a lack of jobs. Jobs were being created so fast that women and children were being employed simply because there were not enough workers.

The problem was that builders could not build homes fast enough to meet the explosive demand. So there simply were not enough homes available for people to rent.

It’s understandable why. To explain, in the year 1760, which was the year the Industrial Revolution began, 8 million people were living in the UK, yet by the year 1900, there were 41 million. This does not even include all the people who left for places like America, Australia, Canada and other places throughout the British Empire, and the world for that matter.

Now here’s the thing, as crazy as it may seem, it is out of this extreme population growth induced poverty that homeownership became widespread, and the reason why is linked to the need to create a secure flow of tax receipts.

I’m not joking on this, bear with me.

The need to finance an empire was game changing for property ownership — taxes are the reason

Who cares about poor people, right? It’s their own fault, that’s what the Victorians thought, that’s what everyone in that era thought, just leave them to their squalor.

Except of course when you need money to fill the government coffers to finance an empire.

To explain, the UK first experimented with income tax in 1798 to support the Napoleonic War. However, it didn’t become a permanent feature until the mid-1800s.

The thing is though, income taxes are worthless if you have a country of people who can’t afford to pay them because they are trapped in horrific poverty, which is exactly the position the Victorians found themselves in.

It was terrible as well, for the government that is, they had an empire to finance you know.

This is why repeated governments, most notably the ones led by the famous Victorian Prime Minister Benjamin Disraeli, started working to increase the wages of workers to increase the amount of income tax they paid *cough to better their conditions.

As part of their efforts to do this, they also made real efforts to make those wages more secure to ensure a secure flow of income tax *cough, to further improve people’s lives.

The unexpected outcome of this was world-changing.

To explain, what works for central governments works for banks, and due to further legislation brought in during World War I by the UK Parliament, specifically around social benefit systems, voting rights, unemployment support, unionisation and much more, the everyday person suddenly became a safe enough bet for banks.

That means the everyday person’s income suddenly became trustworthy enough for banks to allow them to take out a long-term loan i.e. to get a decades-long mortgage.

In terms of why the banks would do this, especially considering in the past the rich and powerful did everything they could to control the land to keep people subservient, they did it because it was profitable. The government allowed it because they still controlled the land, through your rent payments *cough, tax.

See how everything changes yet stays the same?

On a side note, this is why the U.K.’s moves were world-changing for property ownership, because inevitably where the Empire went, everyone followed, creating a world of nations with workers who had their wages protected, and all so they could pay their rent *cough, taxes.

But anyway, the power of secure wages saw home ownership in the UK go from 14 percent in 1914, to over 70 percent by the 1970s.

Since then though, something has been happening, and that something is getting on the property ladder has become increasingly difficult.

The question is, what has changed?

Why properties are becoming unaffordable

History has shown that four things are needed for homes to be affordable, a government willing to allow home ownership, secure wages, accessible mortgages, and enough homes being built to meet demand.

Something from this list is missing in the present. At first glance, people may focus on things like the gig economy making wages less secure, banks being more stingy, governments, rich and powerful etc tetra, and it being for these reasons that homes are becoming less affordable.

However, governments want home ownership as it wins votes, banks are less stingy than ever, and people’s wages are more secure than ever, which can be seen by the fact that people change jobs less than ever because of the security that the average job now provides.

But then if this is the case, why are homes becoming evermore unattainable? Well, because of the increasing house price and wage variability within countries, so regional inequalities.

To explain, sticking with the UK, house prices all across the UK have historically always been relatively similar. So, whether you were purchasing a house in London, Manchester, Glasgow, or anywhere throughout the UK for that matter, the prices would be similar.

But then around 30 years ago, things started changing, as the below graph shows.

The same started happening with wages.

It is not just in the UK this started happening either, but also in other developed countries. For example, see this graph of the US:

In terms of why this has started happening, the reason is simple: the movement of people.

Ease of movement is creating mass regional inequalities

Regional inequalities have always existed, however, in an interconnected world where people can easily uproot and move across the country or the world, those regional inequalities have far more severe consequences.

To explain why, imagine this, you believe that the best opportunities are in Australia, yet you live halfway across the world. Not a problem, right? Not if you are a skilled worker, you can just move there.

Except, even so far as just a few decades ago, it never used to be so easy. In fact, a few decades back, it was harder to move from one city to a nearby one than it now is to move countries — again, at least if you’re a skilled worker.

However, because it now is so easy to move, what we have ended up with is masses of people moving to the most prosperous places, taking their talent with them.

The latter is really important for understanding property unaffordability.

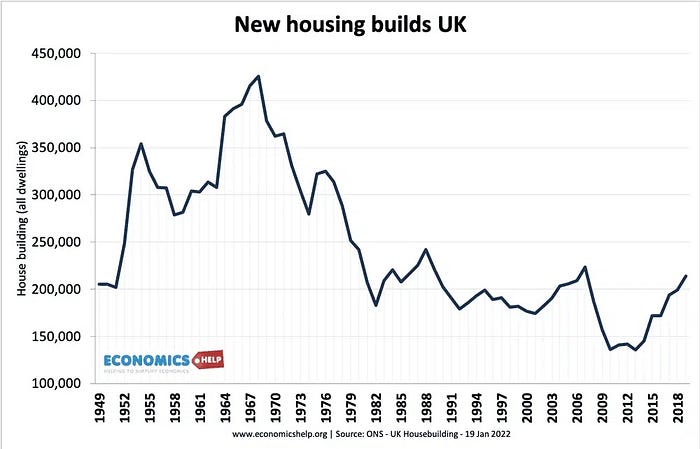

To explain, this mass movement of talent creates two problems, the first is, despite it creating powerful financial incentives to build properties in the more prosperous places, building properties in these places becomes virtually impossible.

This is because firstly, there will be very little space to build new properties, and secondly, due to high homeownership rates, there will be a lot of resistance to building new properties.

Because of this, despite there being a financial incentive to build more properties, it is pretty much impossible to keep up with demand, and as a result, prices remain crazy high relative to wages, despite wages continuously increasing as the most talented people move there.

Now onto the second problem. There is no financial incentive to build homes in the poorer regions because they are poorer and getting poorer by the year.

That means property prices in these regions will remain high relative to wages simply because wages in these regions will go down, and homes won’t be built.

If you bring all this together, what you get is wages going up in the most prosperous places but nowhere near enough to compensate for the housing market squeeze in those locales, and wages going down everywhere else, taking with it the incentive to build homes in those places.

To put it more bluntly, not enough properties are being built in the prosperous areas to meet demand, and not enough homes are being built in the poorer areas to meet demand, as such, in both areas properties are becoming out of reach, and all because regional inequalities are making it difficult to build enough homes to make properties affordable.

That means the reason property ownership is becoming out of reach for so many, is because rising regional inequality is making it impossible to build enough homes to meet demand.

Final words

The reality is, fast transport and ease of movement are making everything too centralised, which is making too many of the most talented people move to big cities, like London, or New York.

This mass talent drain is pushing up property prices in these places far too high for wages ever to have a hope of keeping up, while at the same time, robbing other regions of the talent that could push wages up enough to make homes affordable in those regions.

That means until we start ensuring that there are more opportunities in places outside the central hubs, getting onto the property ladder will probably continue to become increasingly difficult, especially if the rise of single people and migration continues, further pushing up demand.